are political contributions tax deductible in virginia

Political donations are not tax-deductible but contributions to churches mosques temples or other religious groups are taxed. According to the IRS.

Grand Lodge Of Virginia Gwmnma

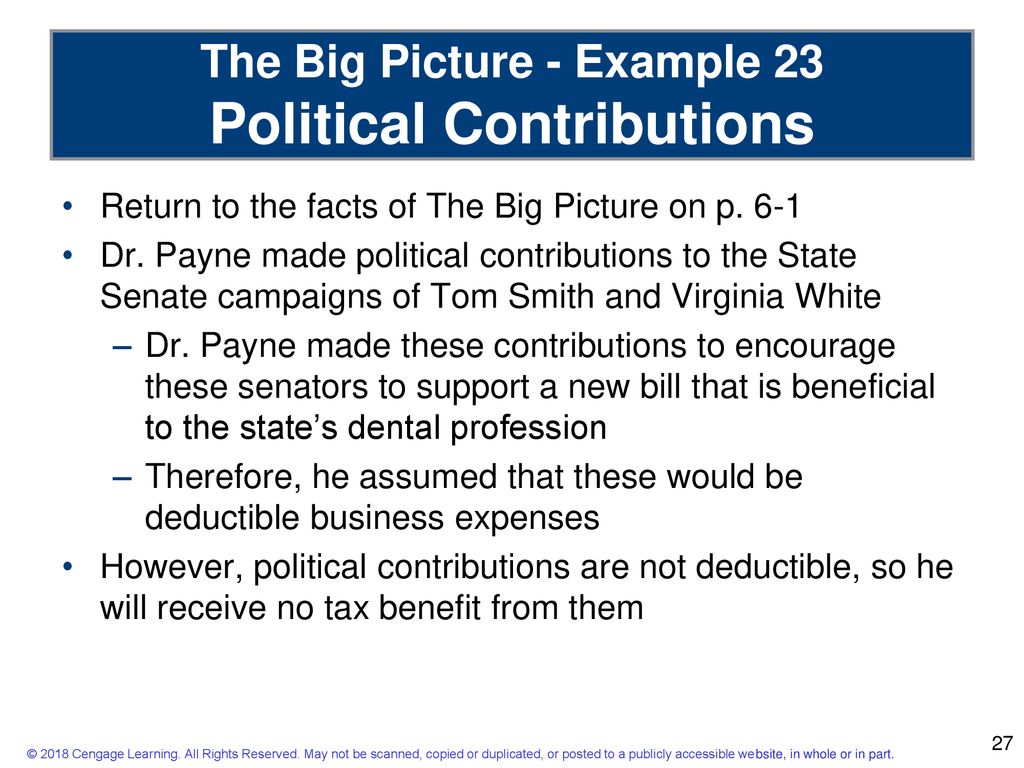

Political contributions deductible status is a myth.

. There are five types of deductions for. Are those tax deductible as charitable contributions for my 2017 federal return. The short answer is no they are not.

It depends on what type of organization you have given to. Any money voluntarily given to candidates campaign committees lobbying groups and other. In a nutshell the quick answer to the question Are political contributions deductible is no.

To be precise the answer to this question is simply no. Direct Political Contributions. The Taxpayer First Act Pub.

A tax deduction allows a person to reduce their income as a result of certain expenses. Required electronic filing by tax-exempt political organizations. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified.

For taxable years beginning on and after january 1 2000 but before january 1 2017 any individual shall be entitled to a credit against the tax levied pursuant to 581-320 of an amount equal to. In comparison those sent by individuals or businesses to non. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years.

The longer answer is. Its important for clients to understand that donations to political parties politicians or political action committees typically are not tax. If the contribution to an ABLEnow account exceeds 2000 the remainder may be carried forward.

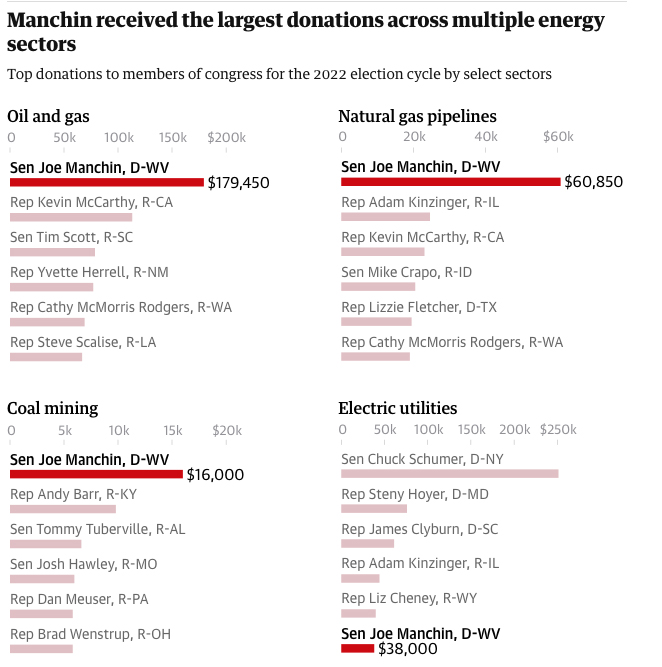

Political contributions are not deductible on your federal tax return. Virginia law requires us to report the name address occupation employer and place of employment for all individual donors over 100 in. I had voluntary contributions deducted from my 2016 Virginia Tax return.

I gave to the. Political contributions are not tax-deductible. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

However if you are. Political Contributions Are Tax Deductible Like Charitable Donations Right. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is.

These business contributions to the political organizations are not tax-deductible just like the individual. If you contributed more than 4000 per account during the taxable year you may carry forward any undeducted amounts until the contribution has been fully deducted. Political contributions arent tax deductible.

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington

West Virginia Income Tax Repeal Evaluating Plans Tax Foundation

West Virginia School Laws Annotated Lexisnexis Store

Tax Report Is Your Political Donation Deductible Wsj

/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Vfbf Agpac Virginia Farm Bureau

Glenn Youngkin S Agenda Includes Major Tax Cuts For Virginia Wamu

Political Contributions Tax Deductions New Irs Rules

Are Political Donations Tax Deductible Credit Karma

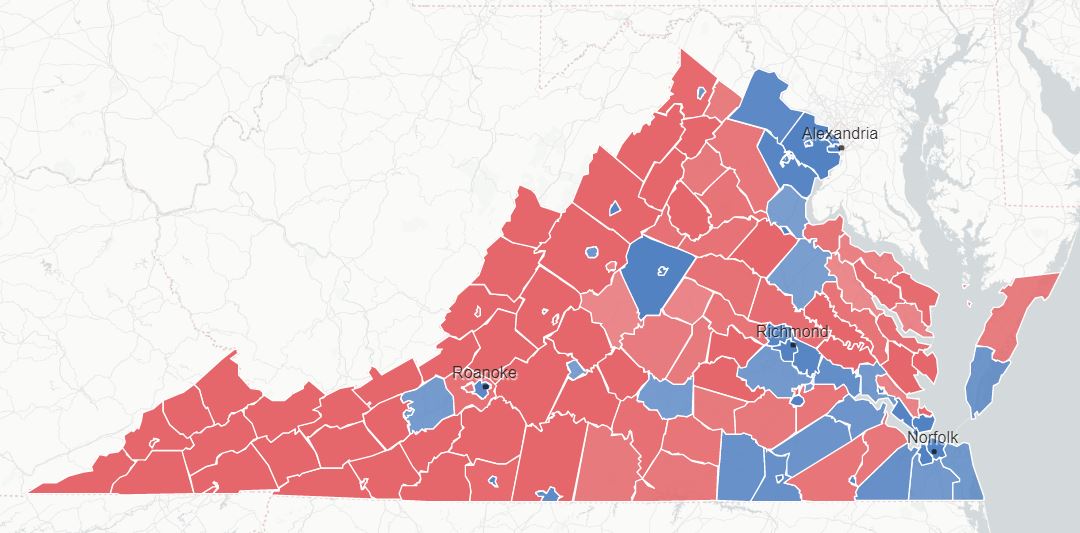

Virginia S New Political Landscape Bacon S Rebellion

Toward Statehood American Battlefield Trust

Are Political Donations Tax Deductible Picnic Tax

Politics In The American States A Comparative Analysis Gray Virginia H Hanson Russell L Kousser Thad 9781506363622 Amazon Com Books

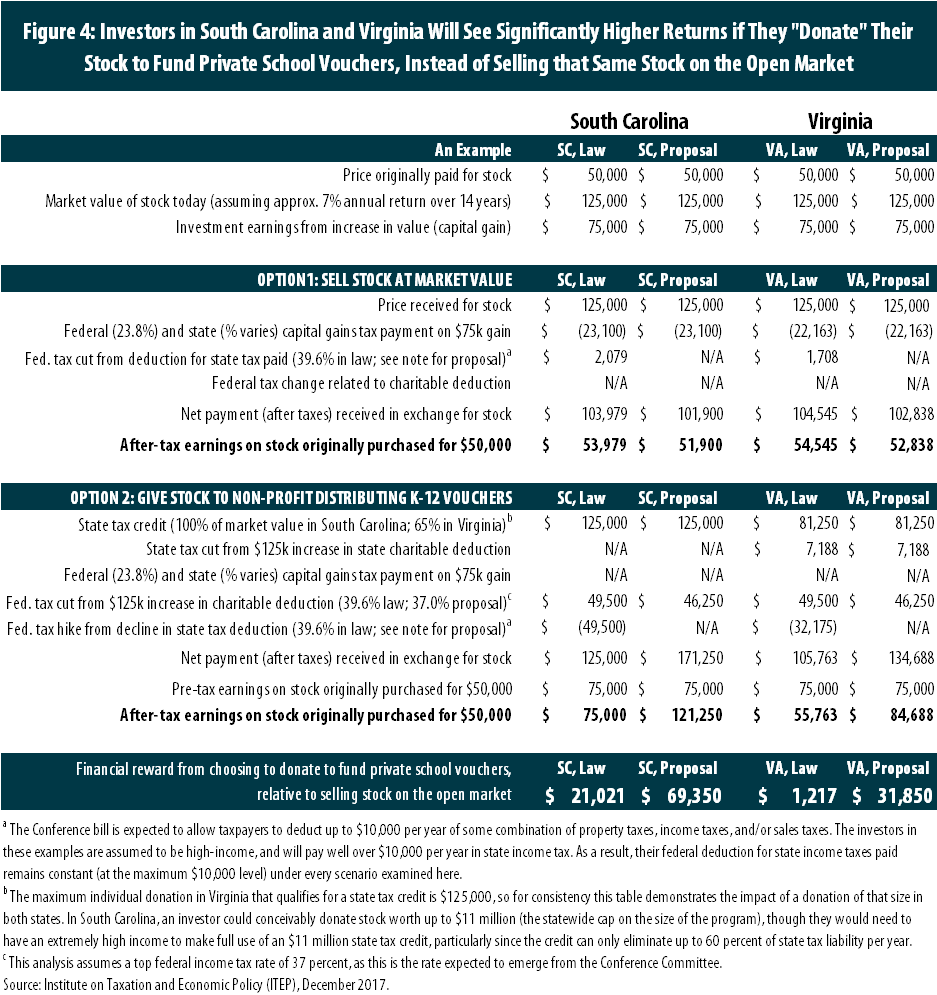

Tax Bill Would Increase Abuse Of Charitable Giving Deduction With Private K 12 Schools As The Biggest Winners Itep

Seceding From Secession The Civil War Politics And The Creation Of West Virginia Wittenberg Eric J Sargus Jr Edmund A Barrick Penny L 9781611215069 Amazon Com Books